Electronics depreciation calculator

The formula to claim under diminishing value method is. The four most widely used depreciation formulaes are as listed below.

Hp 10bii

First one can choose the straight line method of.

. Depreciation asset cost salvage value useful life of asset. Our premium sister site. Base value of the asset x days asset owned365 days x 200 effective life of the asset.

What Are the Different Ways to Calculate DepreciationStraight-Line Depreciation. Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only. It provides a couple different methods of depreciation.

Download your copy today. The calculator makes this calculation of course Asset Being Depreciated -. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000.

This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. You can add 100 150 and 200. Straight Line Depreciation Method.

The calculator allows you to use. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. There are many variables which can affect an items life expectancy that should be taken.

The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. This is a single dimension. How do you calculate depreciation on electronics.

Calculating depreciation can get complicated to do by hand which is why its recommended to use a tool that can calculate depreciation for you. This depreciation calculator is for calculating the depreciation schedule of an asset. In the case of an LCD TV with a five-year useful life that proportion in the first.

This free downloadable PDF is fantastic for calculating depreciation on-the-go or when youre without mobile service to access the online calculator. Based on Excel formulas for SYD. The general way to calculate this sort for depreciation is to take the initial cost of the asset subtract what its value will be at the end of its life and then divide that value by the.

The total depreciable amount is multiplied by a proportion of useful years divided by the sum of all the useful years. Sum-of-Years Digits Depreciation Calculator Calculate depreciation for any chosen period and create a sum of years digits method depreciation schedule. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

Sharp El 738fb 3 X 5 9 16 10 Digit 2 Line Financial Calculator Calculator Time Value Of Money

Pin On Bargains Delivered

Pin On Bargains Delivered

Pin By Carissajane On Cam Graphing Calculator Graphing Calculator

Pin On Bargains Delivered

Personal Asset Depreciation Calculator Fix Your Budget Woes Online Budgeting Tools Budgeting Online Calculator

Solved Chocolate Nirvana Solutionzip Nirvana Solving How To Plan

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Pin On Personal Computers

How Much Would Cost You To Start Selling Your Photos On Stock Agencies Stock Photography Business Stock Photography Photography Business

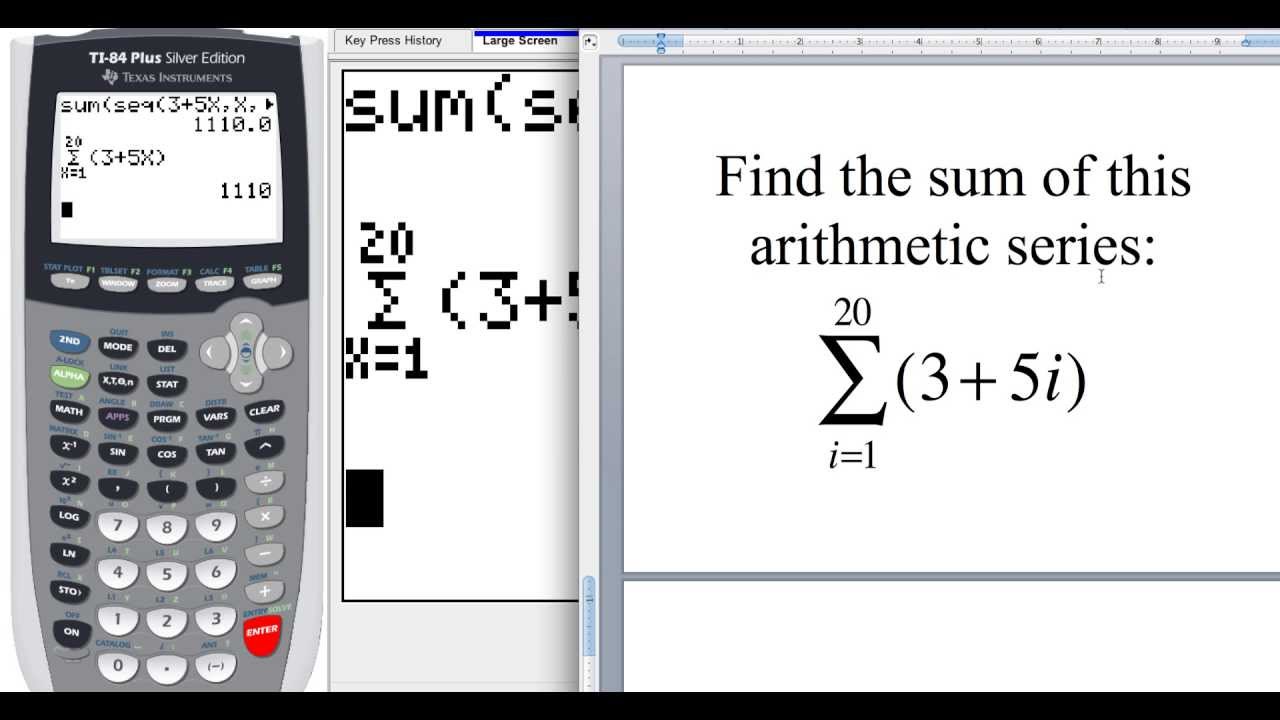

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Graphing Calculators Arithmetic Math Tools

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Calculated Industries Qualifier Plus Iix 3125 Scientific Etsy Vintage Electronics Calculator Scientific Calculator

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Asset

How To Install Tally And Bring License To It Installation Beautiful Blog Folders

Hp 12c Financial Calculator 61 19 Financial Calculator Calculator Calculator Design

B Ll Plus Financial Calculator On Mercari Financial Calculator Calculator Financial