Prime cost method depreciation formula

1 Straight Line Method. Asset cost x days used x 365 100 assets effective life Value on a.

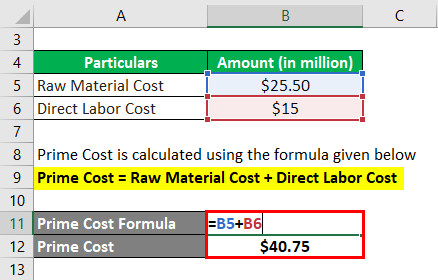

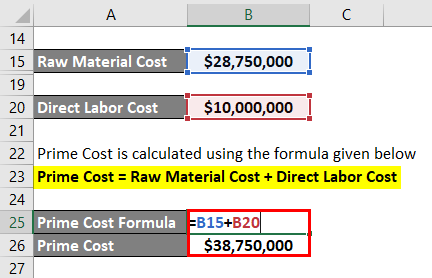

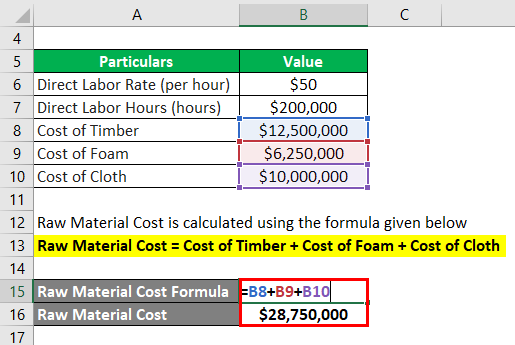

Prime Cost Formula Calculator Examples With Excel Template

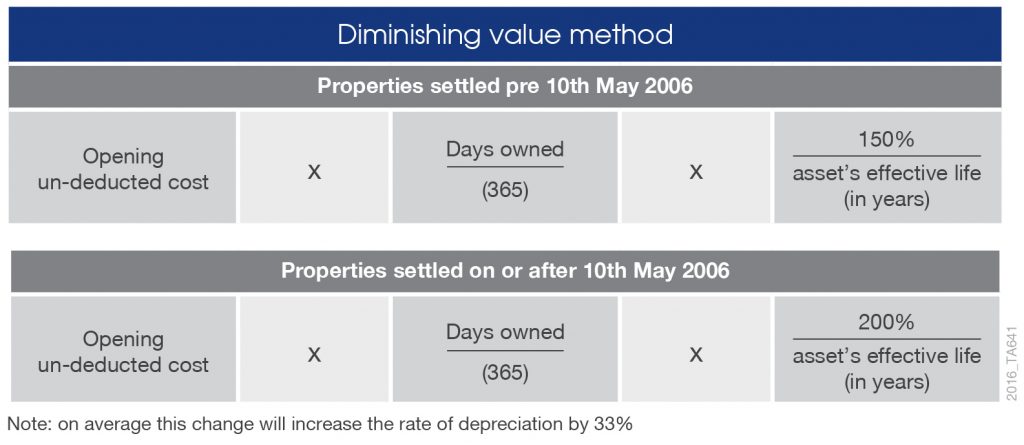

This method returns higher depreciation deductions in the first few years of ownership of the property.

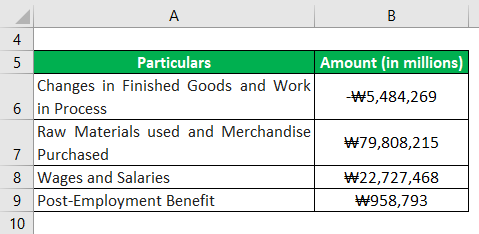

. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Prime cost Direct raw materials Direct labor textPrime cost textDirect raw materials textDirect labor Prime cost Direct raw materials Direct labor. The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life.

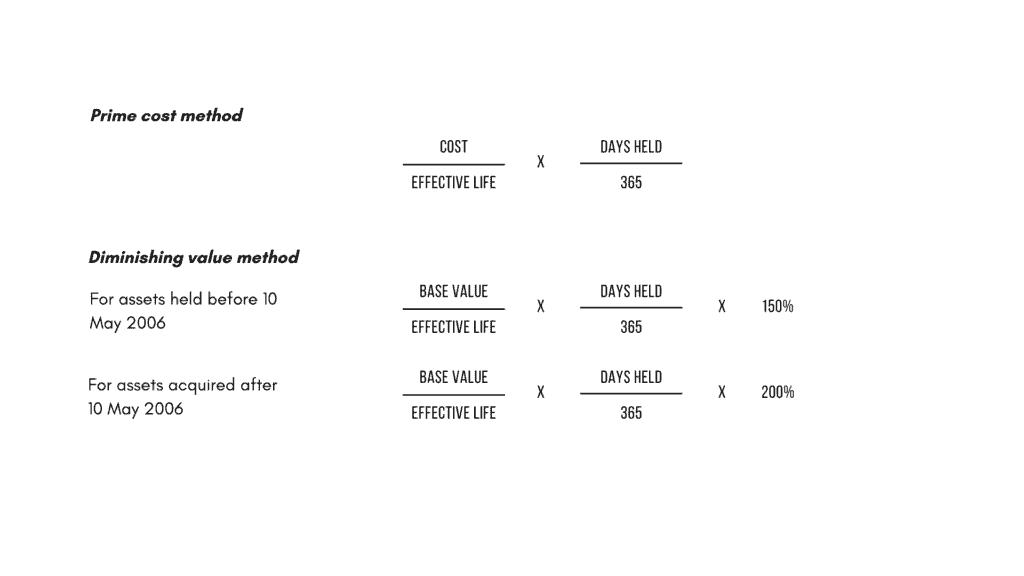

If an asset costs 50000 and. Under the prime cost method also known as the straight line method you depreciate a fixed amount each year based on the following formula. Prime cost straight line and diminishing value methods In most cases you can choose to use either.

The prime cost formula is as follows. The following is the prime cost formula. Assets cost days held365.

Prime Cost Depreciation Method This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following. Prime Cost Depreciation Method. If the cost of an asset is 50000 with an effective life of 10.

Depreciation Expense is calculated using the formula given below. View Formula for Prime Cost Methoddocx from FNSACC 408 at Australian College. Cost of asset x days held 365 x effective life of asset 100 percent If an asset costs 100000 and has a ten-year useful life you may deduct 10 of.

View Depreciation Methodsdocx from BUSINESS 5912 at Academies Australasia College. Assets cost x days held 365 x 100 assets effective life Example. It uses low-value and low-cost pooling to increase the claim on.

Formula for Prime Cost Method. Depreciation Expense Fixed Assets Cost Salvage Value Useful Life Span. The remaining depreciation claim of 521 for the diminishing value method or 212 from the prime cost method after fifteen years would be claimed over the balance of the life of the.

Prime Cost Meaning Formula Calculation Examples

Depreciation Of Vehicles Atotaxrates Info

Declining Balance Depreciation Calculator

Prime Cost Formula Calculator Examples With Excel Template

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Diminishing Value Vs The Prime Cost Method By Mortgage House

Prime Costs Definition Formula Explanation And Example Wikiaccounting

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Cost Formula Calculator Examples With Excel Template

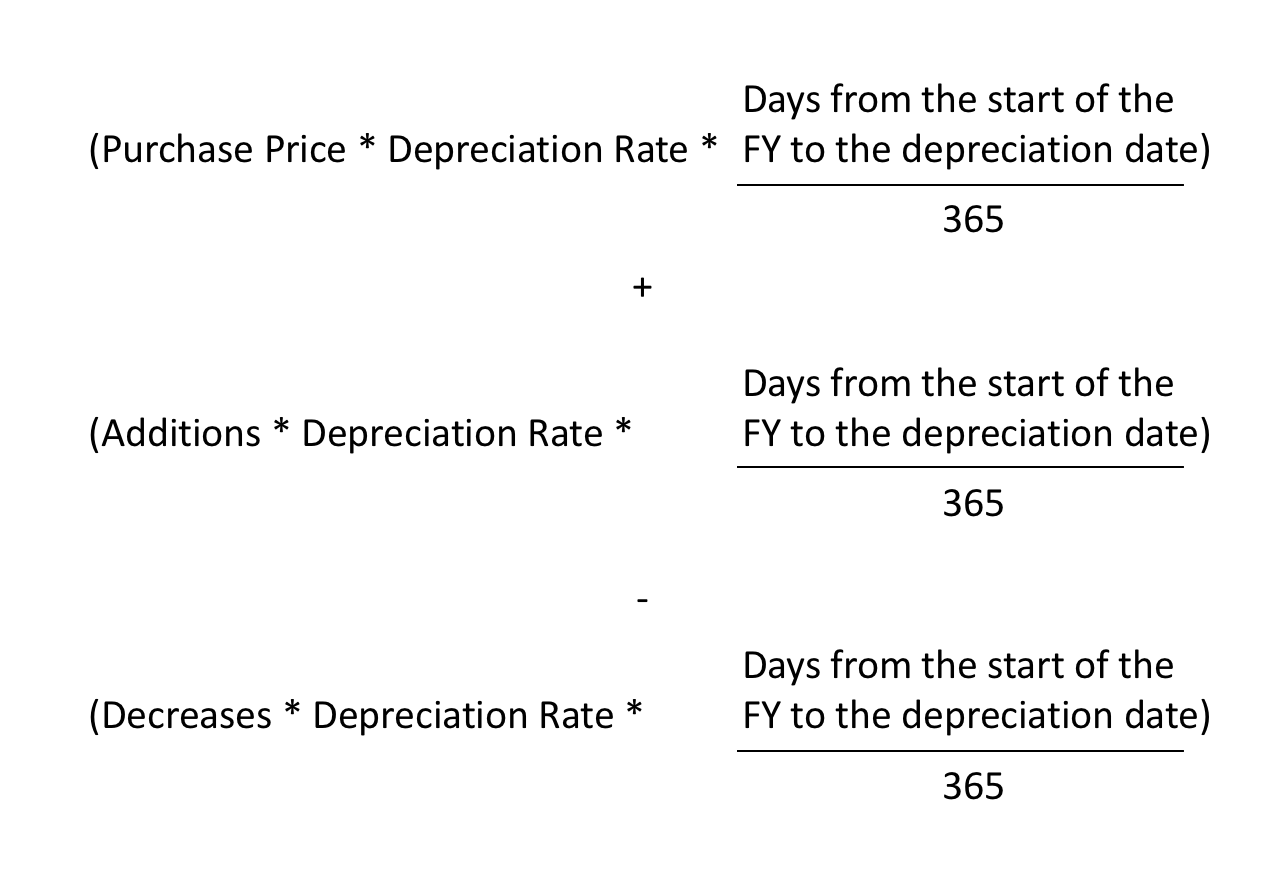

Recording Depreciation Part Way Through The Year Simple Fund 360 Knowledge Centre

Working From Home During Covid 19 Tax Deductions Guided Investor

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Cost Formula Calculator Examples With Excel Template

Which Depreciation Method Is Best For You The Real Estate Conversation

Prime Cost Formula Calculator Examples With Excel Template

Prepare Tax Documentation For Individuals National Core Accounting